How money worries can affect your mental health

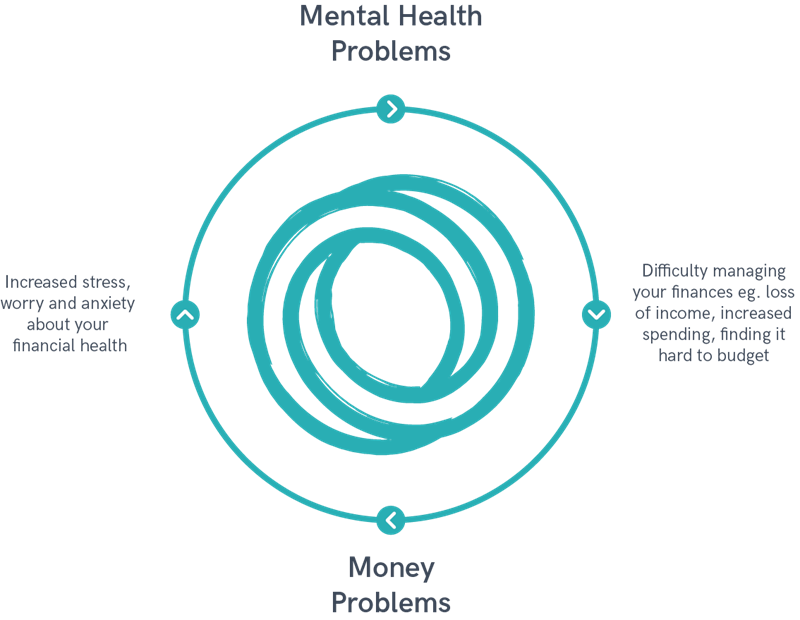

Worrying about money can impact on your mental health, while living with a mental health condition can make earning and managing money more difficult.

Worrying about money and mental health: a vicious cycle

Unfortunately, we know that experiencing a job loss, redundancy, debt, or general financial difficulties can be a time of uncertainty, stress and anxiety which can have a significant impact on your mental health.

Worrying about money can be extremely stressful. You may feel like it is the only thing that you can think about and that your mind is not able to focus on anything else, making managing your money more challenging.

This can feel very debilitating and create the feeling of being stuck in a ‘vicious cycle’ - where worrying about money leads to difficulty managing money and vice versa - because it doesn’t feel like you can change the situation. It can start to impact on your mental health by affecting your thoughts, feelings and behaviours.

You may notice yourself starting to feel very low, and experience feelings such as shame, embarrassment, or guilt. You could find yourself beginning to withdraw from your usual activities and not wanting to spend time with people as much as you usually would.

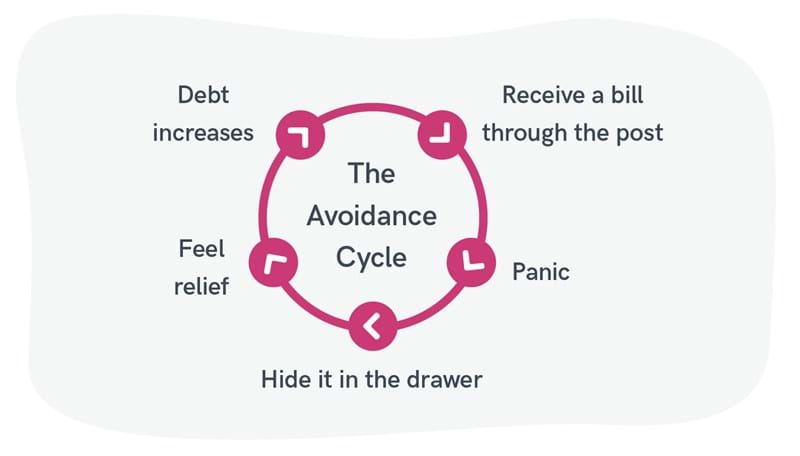

The role of avoidance on mental health and money worries

If you are experiencing money worries, and your mental health is being impacted, you may find yourself avoiding certain places, bills, letters, people, or activities.

Avoidance is easy to do if you are feeling down or stressed because it will often make you feel relieved in the short-term. You want to feel better as quickly as possible, so it makes sense that your brain automatically jumps to this option – even if it is a temporary fix.

During such times, you may avoid opening your post to check bills or make an important phone call to make a debt repayment.

The problem is, when the thing that you are avoiding doesn’t go away, the more you avoid it, the more anxiety-provoking it can feel - which is when debt is likely to build up, and your mental health worsens.

Tackling what you are avoiding head-on is the only way to deal with it – even if it feels scary and you don’t know where to start.

How to manage your mental health when worrying about money

Information to help you manage your mental health when worrying about money is hard to find. This section covers some of these subjects, but you should speak to your GP if you feel concerned about your mental health at any time. For additional tools, you can use the Mental Health and Money Toolkit which you can download for free.

Your mental health can be affected by several things when worrying about money, all of which contribute to the ‘vicious cycle’. We explain this in more detail and describe strategies that could help you improve:

- Stress

- Poor sleep

- Worry

- Negative thinking styles.

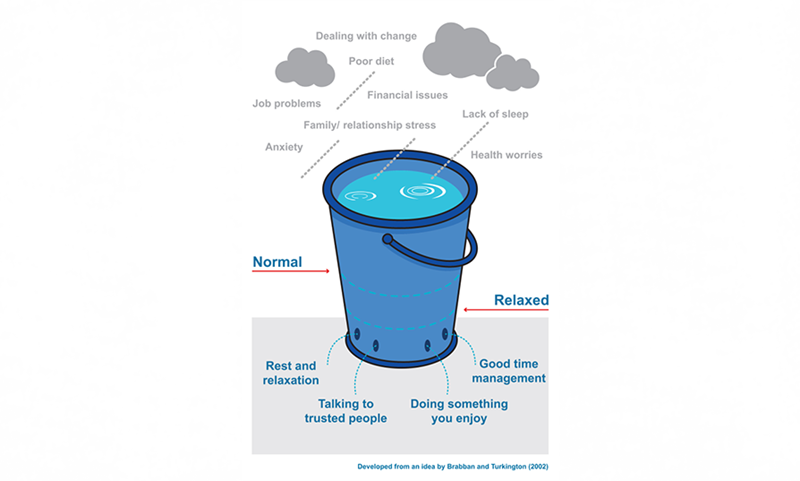

Managing stress if you are worried about money

In a 2017 survey, The Psychological Society suggested that unexpected money problems were the eighth-most stressful life event identified by people in the UK.

We all experience stress to some degree. Some stress can be good; it can push us to work hard. But too much stress can make us feel overwhelmed, and prolonged stress can eventually lead to problems.

To understand stress and how people are affected differently, we can look at the ‘Stress bucket’ analogy.

Managing your stress with a stress bucket

- Above the bucket are clouds – the things that cause you stress. These rain into the bucket and gradually fill it up. Everyone has a different sized stress bucket.

- There are holes in the bottom of the bucket which allows water (stress) to flow through so that it doesn’t overflow. This happens when you are in a good place and managing stress well.

- When you are more stressed, more water (stress) is added to the bucket, which means it begins to fill up quickly.

- Therefore, even a small thing can ‘tip you over the edge’ if our stress bucket is reaching capacity.

- Sometimes it is difficult to reduce the amount of stress coming into your bucket. However, the way to deal with more stress is to ensure that we add more holes to the bottom of our bucket to allow more water (stress) through.

- These ‘holes’ are techniques you can use to keep your mental health from getting worse because of stress. They can be different for everyone, but here are a few examples of ‘holes’ which can help manage your stress levels:

- Exercise

- Healthy diet

- Strong support network

- Meditation or mindfulness

- Rest

- Self-help strategies

Activity: Complete your stress bucket below

- Identify the things that cause you to stress (the clouds) and the things you do to manage them (the holes).

- Also, ask yourself the following questions:

- What size and shape is your stress bucket?

- How full is your stress bucket?

- What current ‘holes’ do you have?

- What are the signs that your bucket is getting too full?

- Are there enough ‘holes’ in your bucket? If not, think about ways to increase these - it’s essential for managing stress.

- Do you turn to unhealthy habits to release stress, and what are they?

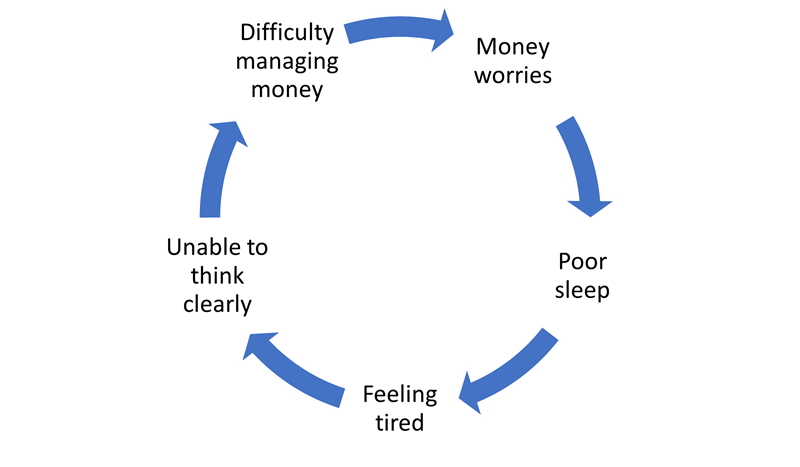

Managing sleep problems associated with stress

In times of stress, it is very common to experience problems with our sleep. This can include trouble falling asleep (tossing and turning, being unable to relax), frequently waking through the night, or sleeping too much.

Sleep is a vital function for our mental wellbeing and physical health. When our sleep is disrupted, it can impact on our ability to concentrate, think clear and problem solve. This is another vicious cycle that we can quickly become trapped within:

Tackling poor sleep can be a gradual process, and often takes time to improve. However, there are some simple sleep tips which can help to put you in a better frame of mind to manage stressful situations and manage money worries:

- Stick to a routine. Our bodies have natural rhythms and prefer consistency, so aim to go to bed and get up at the same time each day - even if you don’t feel like it.

- Avoid naps. If you struggled to sleep the night before, it could be tempting to have a rest through the day - however, this often disrupts your sleep routine and confuses your sleep pattern.

- Do not drink caffeine in the evening (tea, coffee, fizzy drinks, and energy drinks all contain high levels of caffeine). Any caffeine consumption will stimulate your body and will make it harder to have good quality sleep.

- Limit screen time before sleep. Electronic equipment such as phones, the television or computers all emit ‘blue-light’ which sends a signal to our brain to ‘wake up’. Consider turning off all devices for an hour before you go to bed.

- Encourage a cool and comfy environment. To help your body feel relaxed, make sure that your bedroom temperature is cool. You should also make it as dark as possible.

- No clock watching. When we experience trouble sleeping, we can begin to worry about how little sleep we are having. This often creates more anxiety and makes the worry worse, leading to worse sleep - so put your phone out of reach and face clocks so you can’t see them through the night.

- Stop tossing and turning. If you find yourself unable to fall asleep, try to focus on your breathing or relaxing your muscles in your body. You could try tensing and relaxing your muscle groups one by one, starting with your feet, and moving up to your head. Often when we concentrate on our physical sensations, we can distract ourselves from our thoughts enough to fall asleep.

- If you still find yourself awake and restless after about 20 minutes, get up out of bed and do something. Stay in a quiet, dark, or dimly lit space and do something which doesn’t stimulate your brain. Activities could include reading, doodling, folding clothes, tidying shelves.

- Keep your bed for sleeping. You want to send a clear message to your brain that you are going to sleep when you get into bed, so do not confuse it by watching tv, working, or eating in bed.

- Keep a journal by your bed if you find that your mind is racing, and you can’t ‘switch off’ you can write down your thoughts. Then schedule a time the following day to think about them.

How to manage your worry

Worry can be a problem for many of us. Still, if you are experiencing financial difficulties, you can start to feel like worrying is taking up all your time.

It can be challenging to focus on anything else - and you can notice that your concentration and focus is poor because your mind is preoccupied with worries.

A technique that can help is called ‘worry time’. It sounds strange and takes time to master, but it can help control your worry.

How to use ‘worry time.’

- Schedule a specific time in the day as your designated ‘worry time’. This should be around 30 minutes, to begin with, and at a time with no other distractions. It shouldn’t be too close to your bedtime either as this can impact on your sleep.

- Each time you notice yourself worrying through the day, jot down what you are thinking about in a notepad or on your phone. Then tell yourself that you will come back to it at your scheduled ‘worry time’.

- When it is time for ‘worry time’, look at the list of worries you have and worry about them in the allocated slot you have planned. Once the time is over, schedule another ‘worry time’ for the following day and let go of any further worries - writing them down for your next ‘worry time’.

This technique can be useful as it allows you to choose a time to worry rather than the worry entering your mind at any part of the day. You are not telling yourself not to worry, but just to come back to it at a more convenient time.

‘Worry time’ can also be used with the ‘problem solving’ tool in the Mental Health and Money Toolkit, if you can identify a specific problem when worrying.

Unhelpful thinking styles and re-balancing your thoughts

Our thoughts can have a significant impact on the way we feel. When under stress, we can begin to have ‘unhelpful thinking styles’, which then often cause us to feel even worse about a situation.

What are the common unhelpful thinking styles?

| Thinking style | Example |

|---|---|

| Black and white thinking: One extreme or the other | “I’m rich, or I’m skint.” |

| Catastrophising: Thinking the worst-case scenario | “I’ve been made redundant, so I’m going to end up homeless.” |

| Shoulds & musts: Setting rigid rules for yourself and others | “I should be able to afford it.” |

| Mental filter: Focusing on the negative aspects of a situation | “This year has been awful. It has been so stressful, and there have been so many bad things happen.” |

| Mind reading: Thinking you know what other people are thinking | “They think I’m useless.” |

| Predicting the future: Guessing what will happen with limited evidence | “I know they won’t help me.” |

If you notice these unhelpful thinking styles in yourself, try to use the following prompts to help re-balance your thoughts. The aim is not to get rid of the thoughts, but to keep things in perspective and stop them from escalating.

- Is this fact or opinion?

- What would I say to a friend who thought this?

- How would this look to an outsider?

- What actual evidence have I got to support this?

- How much will this matter in five years?

You may also find this video by Mental Health UK helpful:

Next steps

It is important to remember that looking after yourself and your wellbeing is extremely important when under stress and experiencing challenging times.

Be kind to yourself and speak in a way you would talk to a friend or a loved one - we are often much more critical towards ourselves than we would be with somebody else.

Try out some of the options above - they may not help instantly, often they will take some practice.

The key thing to remember is that sorting financial difficulties can be challenging and looking after yourself will put you in a better position to do this.

Reach out to friends, family, and professionals for support, and take one step at a time, and download the free Mental Health and Money Toolkit. The smallest changes can amount to significant outcomes, both in terms of both your finances and mental health.